Business News of Tuesday, 16 April 2024

Source: www.ghanaweb.com

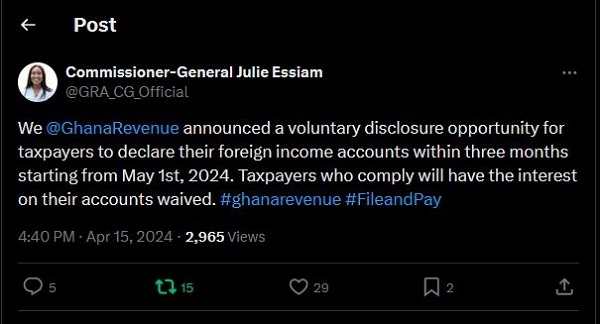

The Ghana Revenue Authority (GRA) has announced a voluntary disclosure opportunity for taxpayers to declare their foreign income accounts within three months, starting from May 1, 2024.

According to the authority, taxpayers who comply with this directive will have the interest on their accounts waived.

In a series of posts shared via X on April 15, the Commissioner-General of the GRA, Julie Essiam, said the implementation of the tax declaration policy on foreign income accounts has already begun.

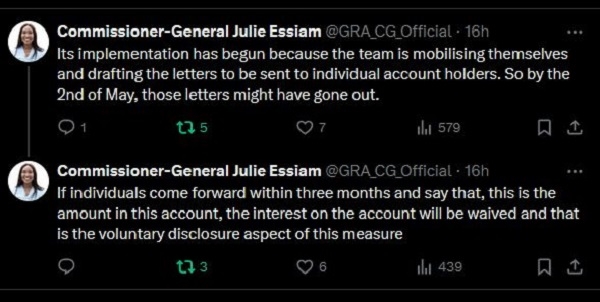

She added that GRA teams are already drafting letters to be dispatched to individual account holders.

“So, by May 2, 2024, those letters might have gone out,” Julie Essiam wrote via X.

She added, “If individuals come forward within three months and say that, this is the amount in this account, the interest on the account will be waived and that is the voluntary disclosure aspect of this measure.”

The latest development by the revenue arm of the government follows an announcement made by the Commissioner-General on April 13, 2024, stating a new compliance measure targeting the foreign incomes of resident Ghanaians.

This initiative is set to replace the suspended Value Added Tax (VAT) on electricity and aims to generate sustainable revenue beyond 2024.

According to the GRA boss, this measure is not new but has been part of the law for some time, although it has not been implemented effectively.

“So, the measure that we put in place is a compliance measure on foreign income of resident Ghanaians.

“This measure is already in the law, as the minister said, so it is not a new measure. The difference is that its implementation and application have not been implemented effectively,” the GRA Commissioner-General said in her brief remarks at the joint IMF, BoG and Ministry of Finance presser held in Accra on April 13, 2024.

Julie Essiam added that “The GRA, with support from the Organization for African, Caribbean, and Pacific States (OACD), has refined the processes and structures to ensure effective implementation.

“So for us to implement this measure, we have, with the aid and assistance of the OACD, gone through sustainable processes and structures to ensure that when we implement this measure, the sustainability of this measure is going to go beyond 2024 in our revenue numbers.

“So this is the measure that, together with the Government of Ghana and our mother ministry, the Ministry of Finance, is going to take place or is going to replace the VAT on electricity.”

The move comes as part of the government of Ghana’s efforts, in collaboration with the Ministry of Finance, to find a long-term solution to the country’s fiscal needs, especially in revenue mobilization.

Julie Essiam said she was confident that this measure will not only be sustainable but will also credibly replace the projected GH¢1.8 billion in revenue target, marking a significant shift in the nation’s tax policy landscape.

Kanawu Radio number 1 news portal

Kanawu Radio number 1 news portal